In a sector where every risk has financial consequences, Bitsight gives you the visibility and intelligence to manage exposure, strengthen vendor oversight, and protect the trust your business depends on.

Stay ahead of financial risks with AI-powered cyber risk intelligence.

Across your own ecosystem

Manage security performance across your ecosystem.

Ensure your cybersecurity spending is as strategic and effective as your financial services. Understand and secure your firm’s expanding attack surface, benchmark against the industry’s best, and confidently tell your cybersecurity performance story in a way your stakeholders understand.

Across your vendor network

Mitigate third-party cyber risk from financial partners.

As your ecosystem expands, protecting your institution requires real-time visibility into every vendor—bank or nonbank, affiliated or independent, domestic or foreign. Monitor risk continuously and ensure each partner meets financial security standards from onboarding through contract close.

Across the deep and dark web

Leverage real-time findings from across the underground.

Get real-time visibility into threats like compromised credentials, ransomware, and exploitable vulnerabilities tied to your digital footprint. Bitsight Cyber Threat Intelligence helps you translate dark web signals into prioritized action—so you can reduce third-party risk, protect customer data, and stay compliant with FFIEC, NYDFS 500, DORA, and more.

Cyber risk is escalating. Financial institutions are in the crosshairs.

Expert Insights

Visibility is still limited.

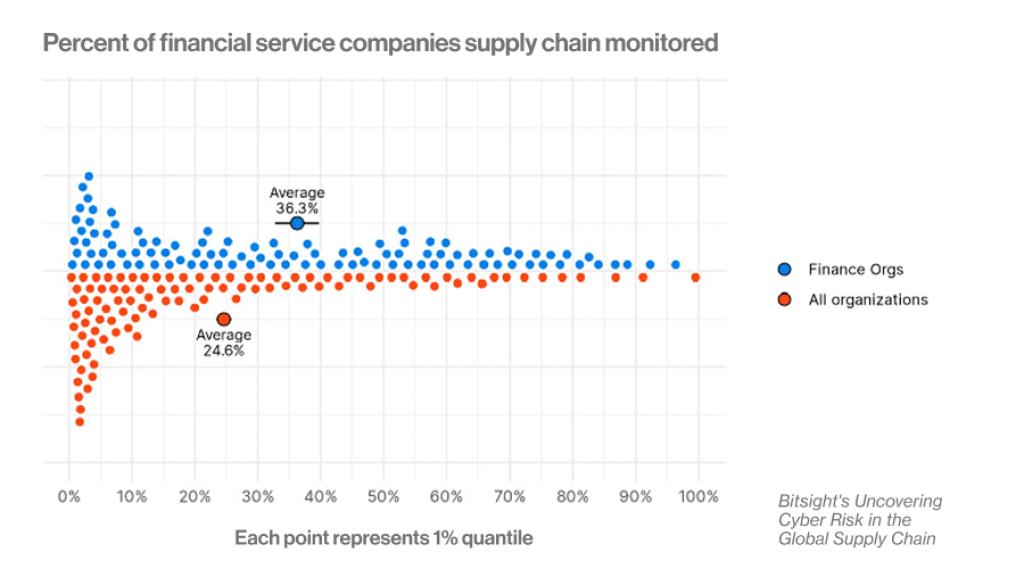

"Financial organizations monitor only 36% of their supply chain, better than the 25% global average, yet it still leaves major blind spots that attackers can exploit."

Dr. Ben Edwards

Principal Research Scientist

TRUSTED BY FINANCIAL LEADERS

Bitsight is the vendor of choice.

As security leaders, we’re inundated with isolated alerts that don’t tell the full story.

What stands out with Bitsight is how threat intelligence is connected into our broader risk context–real-time external exposure, vendor risk posture, and insights across the open, deep and dark web. That context helps us move beyond chasing incidents to making proactive, business-driven security decisions.”

Bryan Perkola

Senior Vice President, First Community Credit Union