Is your business adopting vendors faster than you can address their security issues? Get the keys to scaling your Vendor Risk Management program, from assessment to ongoing monitoring, and proactively mitigate risk in an ever-expanding third-party network.

A Guide to Third-Party Vendor Risk Management for Financial Institutions

When it comes to cybersecurity, the financial services sector needs to implement strong cyber risk management programs. One factor that contributes to this performance is regulations and standards. Laws such as FFIEC IT and GDPR, coupled with standards such as SOC2 have spurred financial services companies to create some of the most stringent programs in the world.

Another factor is money. Financial services firms have a higher security budget than others due to the very sensitive personal and financial information they handle. And, should a cyberattack occur, the costs are high. According to the Ponemon Institute and IBM, the average cost of a data breach in the financial sector is $5.97 million per incident.

But as threats and regulations continue to evolve, there’s always work to be done, particularly when it comes to supply chain cyber risk:

- 62% of network intrusions originate with a third-party

- 73% of organizations have experienced at least one significant disruption from a third-party in the last three years

In this blog, we explore the risks that an increased reliance on vendors brings and the critical elements of an effective vendor risk management (VRM) program for financial institutions.

Understanding the third-party landscape

Financial services firms are part of a vast, interconnected, third-party ecosystem of partners and suppliers. Many of these vendors support essential operations and have access to sensitive systems and data.

Skilled hackers target these vendors who may not have stringent security controls in place. Once a vendor’s network is breached, hackers can insert malicious software that is then propagated across the supply chain, as happened with the SolarWinds hack in 2020, which impacted 18,000 downstream customers.

This and more recent third-party data breaches demonstrate the importance of managing third-party risks.

5 risks that VRM must address

Breaches that occur as a result of poor vendor security practices can have significant impacts. Here are some of the risks that may arise from a financial institution’s use of third parties:

1. Compliance risk: Regulators, such as the SEC, are increasingly requiring that financial institutions step up their third-party risk management programs. Specifically, firms must conduct vendor cybersecurity assessments and include security requirements and standards in third-party contracts. Furthermore, if a vendor is breached, firms are obligated to report the incident to impacted clients. Finally, security and VRM leaders must keep the board of directors apprised of the security posture of companies in their vendor portfolios.

2. Reputation risk: Data breaches can severely damage an institution's reputation and negatively affect customer retention and acquisition.

3. Financial risk: Regulatory violations or data breaches can result in millions of dollars in fines and remediation and digital forensic investigation costs.

4. Operational risk: Cyberattacks cause significant disruption to business operations, productivity, and continuity as they try to contain the breach and restore systems and data.

5. Strategic risk: Cyber incidents can drastically limit a firm’s ability to meet its strategic goals, such as digital transformation, building market integrity, attracting talent, M&A, new product development, and delivering customer value.

Overcoming common challenges in financial services VRM

While many firms are now contractually requiring their vendors to meet minimum cybersecurity standards, ensuring they meet and maintain them is a significant challenge. This challenge is due to two reasons:

- Manual processes: Current methods of VRM, such as point-in-time security assessments and spreadsheet-based questionnaires, are inefficient, time-consuming, and difficult to scale as a firm’s vendor portfolio grows and regulations evolve.

- Lack of visibility into third-party risk: Most financial services organizations don’t have visibility into their vendors’ changing security practices and postures.

However, financial services can overcome these challenges and manage vendor risks by making the switch to an automated VRM system, such as Bitsight Vendor Risk Management.

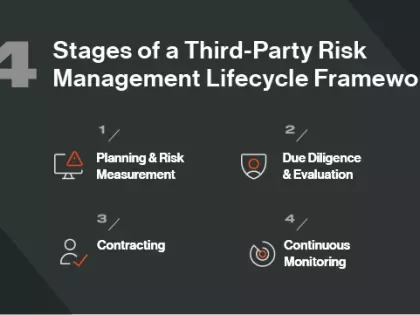

Bitsight VRM automates the risk assessment process while delivering unprecedented visibility into vendor risk, in one unified platform. With Bitsight VRM, part of Bitsight for Third-Party Risk Management, security and risk management teams see four key benefits.

Automate due diligence

Manual processes often slow down due diligence across the hundreds, if not thousands, of vendors that financial services firms work with. This compromises business agility and delays vendor onboarding.

A fully integrated solution, like Bitsight VRM, streamlines and scales the risk assessment process. Pre-built and custom questionnaires and automated workflows make information gathering and tracking processes more efficient. Plus, VRM data is captured in a single dashboard for ease of monitoring and increased productivity and efficiency.

Bitsight VRM also adds a layer of independent validation to the risk assessment process by automatically detecting red flags in vendor responses.

Manage regulatory compliance

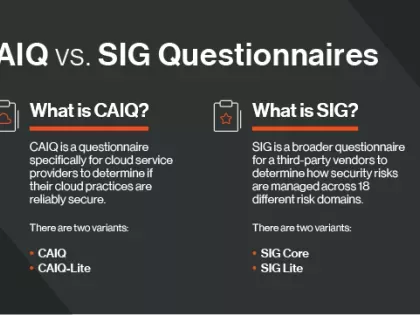

VRM teams use industry standard questionnaires for global security certifications and frameworks, including NIST, ISO, PCI, GDPR, SIG, SOC2, and more. Bitsight then automatically maps and reviews each vendor’s alignment with the appropriate standard. If a vendor deviates from requirements, teams can request and monitor remediation efforts using automated workflows.

Continuously monitor third-party risk

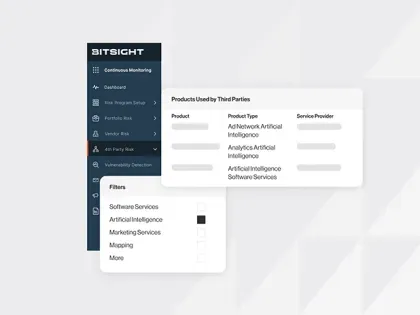

Bitsight VRM eliminates blind spots across the third-party attack surface by continuously monitoring vendor security postures (during onboarding and for the life of the relationship).

If risk is detected or a vendor’s security performance deviates from pre-agreed risk thresholds, security teams receive near-real-time alerts. In addition, firms can invite their vendors to collaborate within the Bitsight platform for an outside-in view of their security data, allowing quicker and more efficient risk remediation.

Report effectively to the board

With dashboard views into vendor risk assessments, trends, security violations, and remediation actions, security and VRM leaders can quickly and confidently keep the board and C-suite informed and assured of program performance.